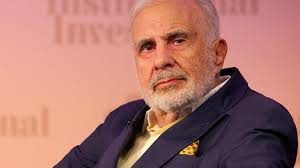

Leadership at Oklahoma City’s SandRidge Energy, Inc. sent another update to shareholders this week regarding its fight with activist investor Carl Icahn. In it, leadership begged shareholders to reject Icahn’s takeover efforts.

In a Tuesday announcement, the company said it provided a status update and also urged shareholders to vote for all five of the company’s directors: Sylvia Barnes, Kenneth Beer, Michael Bennett, William Griffin and David Kornder as well as two independent directors proposed by Icahn. They are John “Jack” Lipinski and Randolph Read. The board said it has “carefully vetted and offered to appoint them,” but Icahn refused the offer.

The annual shareholders meeting will be held June 19. In the note to shareholders, the SandRidge Board also urged them to for “for” a ratification of the continuation of a short-term shareholder rights plan through Nov. 26, 2018 protecting shareholders from what it called “unfair, abusive or coercive takeover strategies, including acquisition of control without payment of an adequate premium.”

Director and CEO William Griffin Jr. signed the letter, stating the board is “moving forward expeditiously” on its strategic alternatives. He said with the support of the board’s independent financial advisor, RBC Capital Markets, the company has entered into mutual non-disclosure agreements with several of them, including Carl Icahn and his affiliates.

“These parties are thoroughly reviewing the information contained in our confidential data room and preparing to participate in management presentations that begin this week,” said Griffin.

“As we previously announced, we will consider divestment or joint venture opportunities associated with our North Park Basin assets, potential corporate and asset combination options and a sale of the Company, including offers, if presented, from Icahn.”

But Griffin did not expect to complete the process before the annual meeting. However, he indicated the board hopes to receive initial indications of interest before the end of June.

Griffin told shareholders that it had made offers to Icahn of naming two of his proposed directors but he refused the offer “because it did not give Icahn complete control.”

” Icahn is seeking to gain control of SandRidge without paying an appropriate premium or participating in a competitive process. Icahn has made clear its desire to acquire SandRidge. However, having nominated for election a full slate of seven candidates, including two who work directly for Icahn and one former employee (the “Icahn Nominees”), to sidestep the ongoing impartial process, Icahn is not content to compete fairly with

other potential counterparties in the thorough and even-handed process being conducted by the SandRidge Board.”

Griffin concluded by stating that it would be impossible for a Board dominated by Icahn nominees to run a fair, unbiased process that may result in selling the company to Icahn.