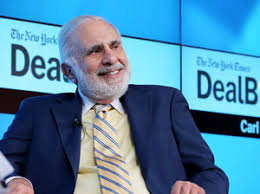

Leaders of Oklahoma City’s SandRidge Energy were scheduled to meet Wednesday with investor Carl Icahn over his demands for a shake-up of the company’s board of directors.

His demands came after he publicly challenged SandRidge Energy’s proposed $746 million acquisition of Bonanza Creek Energy in Colorado. Icahn and other investigators argued it was too expensive and only increase the company debt after its recovery from 2016 Chapter 11 bankruptcy.

The company finally backed out of the acquisition and the move was followed by Icahn’s call for two board members to be replaced. He wants one replacement to be chosen by him and the other by shareholders.

“I’m not necessarily against the idea of them buying some assets at a good price, but I was adamantly against diluting the shareholders, especially in order to overpay for Bonanza,” Icahn was quoted in a report by Reuters.

Icahn is not a fan of SandRidge Chief Executive James Bennett. Earlier in the month, he criticized Bennett for overseeing what he called “a period of massive value destruction” at SandRidge.

“I don’t mind a CEO making a lot of money if the shareholders have also prospered. But this is certainly not the case here,” Icahn said in the interview.

SandRidge declined to provide details of its executives’ goals for Wednesday’s meeting, but spokesman David Kimmel said in a statement that its board and management “value constructive shareholder dialogue.”

The company has not set a date for its 2018 shareholder meeting nor a deadline for shareholders to submit resolutions for the proxy. The 2017 meeting was held in June.

Icahn, who owns 13.5 percent of the oil company, also has called on directors to remove a so-called poison pill barring individual shareholders from accumulating more than 10 percent of shares.

SandRidge will meet with other top shareholders in additional to Icahn. Guggenheim Partners Investment Management and Fir Tree Partners, both of which opposed the Bonanza Creek deal, did not respond to requests for comment.